The impacts of hurricanes analyzed in the previous post in this series may be far-reaching in the Second District. In a new Staff Report, we study how banks in Puerto Rico fared after Hurricane Maria struck the island on September 17, 2017. Maria makes a worst case in some respects because the economy and banks there were vulnerable beforehand, and because Maria struck just two weeks after Hurricane Irma flooded the island. Despite the immense destruction and disruption Maria caused, we find that the island’s economy and banks recovered surprisingly quickly. We discuss the various protections—including homeowners’ insurance, federal aid, and mortgage guarantees—that helped buttress the island’s economy and banks.

Double Strike

Puerto Rico’s location in the Caribbean leaves it highly exposed to all manner of severe weather, including floods, droughts, tropical storms, and winter swells. Since 1955, FEMA has declared forty-five disasters there, twenty-eight of which were hurricanes or severe storms.

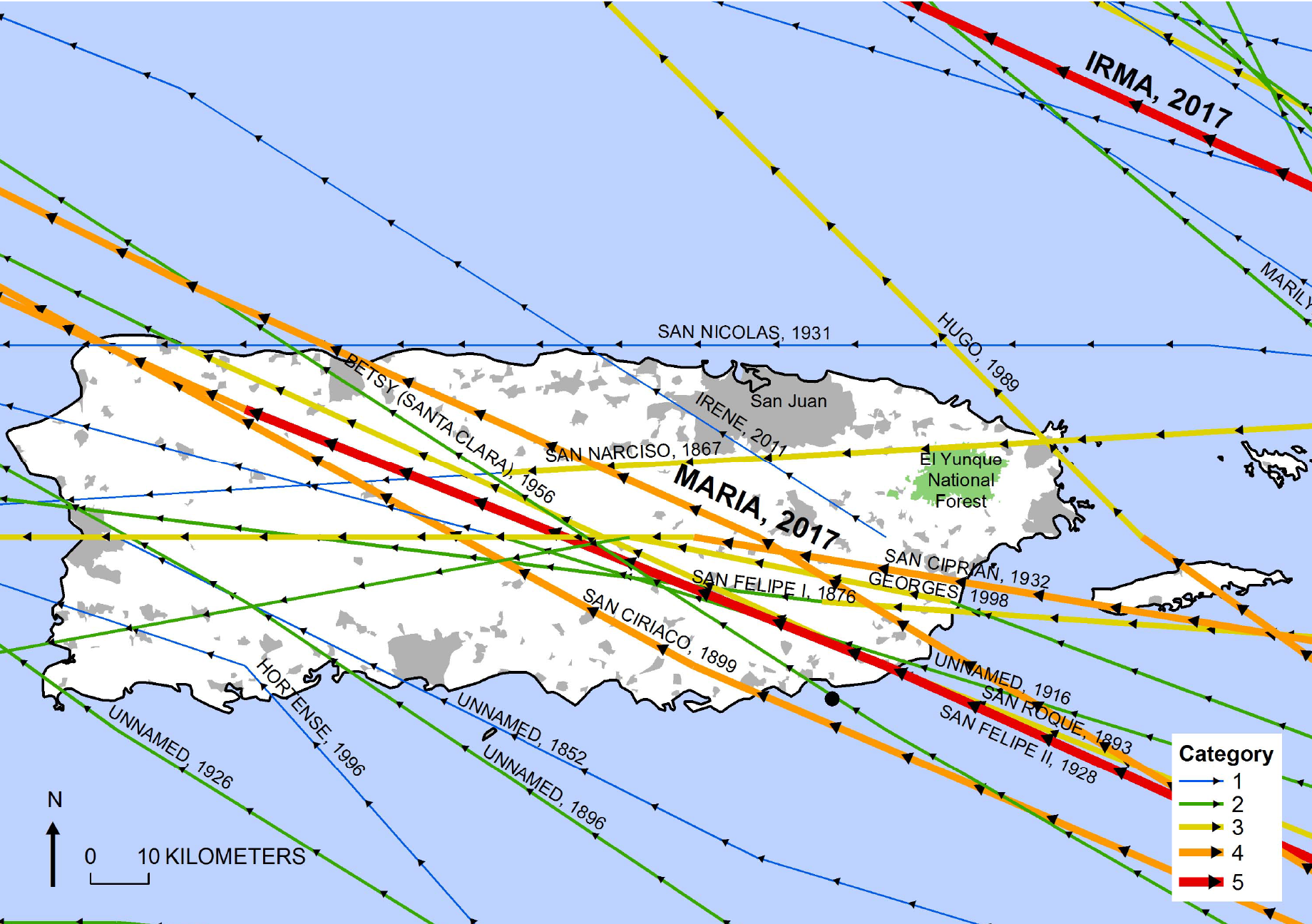

The Paths of Hurricanes Maria and Irma

Source: U.S. Geological Survey.

The full fury of Irma (the eye) passed thirty miles north of the main island of Puerto Rico on September 6, but the island was still buffeted by 55 mph winds and a foot of rain in places. Culebra and Vieques, smaller islands off the main island, were especially hard hit. The island was still reeling from Irma when Maria struck full force on September 17, with winds of 155 mph and maximum rainfall of 38 inches in 48 hours. Maria destroyed 80 percent of the island’s electrical grid and blacked out most of Puerto Rico’s 3.4 million residents for months. Thousands of homes were damaged or destroyed. Flash floods caused landslides and destroyed many bridges. FEMA estimated damages from Maria at $90 billion, making it the third costliest hurricane in U.S. history. The combined damages from Maria and Irma nearly exceeded the island’s $104 billion GDP in 2016.

Economic Impact

The chart below tracks employment in Puerto Rico using August 2017 as the benchmark (100). The trend was flat or downward before Maria struck, reflecting longer-term economic difficulties that are discussed in our paper. Employment fell sharply, about 7 percent, after Maria but had fully recovered by July 2018. Interestingly, employment grew faster afterwards than before Maria, consistent with this recent study documenting positive medium-term effects of weather disasters on local employment and income.

Puerto Rico’s Employment Fell Sharply after Maria but Recovered Quickly

Notes: Chart plots total private employment in Puerto Rico relative to August 2017.

Bank Impact

There were three banks headquartered in Puerto Rico when Maria struck, institutions that collectively held 75 percent of all domestic deposits on the island. In our analysis, we compare these banks’ performance to a control group of U.S. banks that were not exposed to any type of weather disasters over the post-hurricane comparison period.

The first sign of trouble at banks is usually mounting loan delinquencies. The left panel below shows that delinquencies at Puerto Rico banks rose after Maria, particularly compared to the control, but the deterioration was modest and fairly short-lived. Bank income also fell sharply afterward, as shown in the right panel, but rebounded within two quarters.

Puerto Rico Banks’ Performance Deteriorated after Maria but Rebounded Quickly

Sources: Bank call reports and Y9-C filings.

Notes: Panels show means for each period for three Puerto Rico-headquartered banks and a control group of U.S. banks that were not exposed to any (FEMA-declared) weather disaster between 2017:Q3 and 2019:Q3. The vertical line indicates when Maria struck. Delinquency rate = 90 days+ past due. Income is measured in log terms.

We confirmed these effects more rigorously in our paper, where we control for individual bank characteristics and economic conditions. We also look at other bank performance measures, such as capital and default risk, but do not find significant changes. The modest (or null) impacts we find for Puerto Rico banks, though possibly surprising, are consistent with the results of other recent studies (Blickle et al., 2022; Brei et al., 2016; Gallagher and Hartley, 2017).

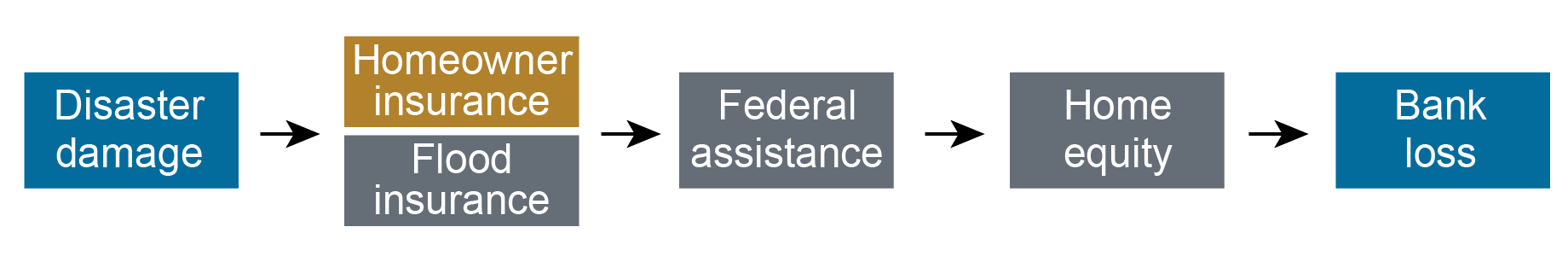

Mitigated Disasters

Despite the aggregate catastrophic impacts of Irma-Maria, multiple layers of protection helped mitigate the impact (see chart below).

Layers of Disaster Protection

The first mitigant is homeowner’s and flood insurance. By enabling homeowners to repair damaged property, rather than abandon it, insurance protects lenders indirectly.

Federal disaster assistance may also provide indirect protection. Puerto Rico received $20.6 billion in FEMA aid after Irma-Maria, $19.3 billion in public assistance for rebuilding infrastructure, and $1.4 billion in individual assistance to aid uninsured households and individuals. By supporting employment and recovery, this aid may have benefited banks indirectly, but the benefit is difficult to quantify.

Mortgage insurance through the Veteran’s Administration and Federal Housing Administration provided direct protection to banks. These agencies guarantee mortgage repayment in the event of default due to damage to the home or unemployment (among other events). Using McDash data, we found that over 30 percent of mortgages in Puerto Rico were covered by one or the other guarantee when Irma-Maria hit. Loss rates on those mortgages through November 2019 were just 0.1 to 0.2 percent, compared to 1 percent on conventional mortgages without private or government mortgage insurance.

Borrower’s home equity is another layer of direct protection to banks, one they control though their underwriting. In Puerto Rico, however, home equity had been declining for years before 2017, as the long economic downturn depreciated home prices. Thus, home equity levels likely did not provide strong support to banks holding these mortgages.

Takeaways

Puerto Rico banks were surprisingly resilient against the back-to-back hurricanes that wracked the island in September 2017, thanks to the mitigating effects of property insurance, federal mortgage insurance and disaster assistance, and, to a lesser extent, their own underwriting. This finding is reassuring from a financial stability perspective, but also for households that might need additional credit to rebuild and recover from weather disasters. We caution, however, that these mitigants may themselves be threatened by climate change if private and federal insurers withdraw from disaster zones or increase coverage costs prohibitively or if federal disaster assistance becomes scarcer.

Peter Anagnostakos is a quality management supervising examiner in the Federal Reserve Bank of New York’s Supervision Group.

Jason Bram was a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Benjamin Chan is an institutional supervision program manager in the Federal Reserve Bank of New York’s Supervision Group.

Natalia Fischl-Lanzoni is a research analyst in Financial Intermediation in the Federal Reserve Bank of New York’s Research and Statistics Group.

Hasan Latif is an institutional supervision supervising examiner in the Federal Reserve Bank of New York’s Supervision Group.

James M. Mahoney is an institutional supervision program director in the Federal Reserve Bank of New York’s Supervision Group.

Donald P. Morgan is a financial research advisor on Banking Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ladd Morgan is a capital markets risk supervising examiner in the Federal Reserve Bank of New York’s Supervision Group.

Ivelisse Suarez is an institutional supervision supervising examiner in the Federal Reserve Bank of New York’s Supervision Group.

How to cite this post:

Peter Anagnostakos, Jason Bram, Benjamin Chan, Natalia Fischl-Lanzoni, Hasan Latif, James M. Mahoney, Don Morgan, Ladd Morgan, and Ivelisse Suarez, “Banks versus Hurricanes,” Federal Reserve Bank of New York Liberty Street Economics, November 20, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/banks-versus-hurricanes/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).