After a period of relative stability, a series of bank failures in 2023 renewed questions about the fragility of the banking system. As in previous years, we provide in this post an update of four analytical models aimed at capturing different aspects of the vulnerability of the U.S. banking system using data through 2024:Q2 and discuss how these measures have changed since last year.

How Do We Measure Banking System Vulnerability?

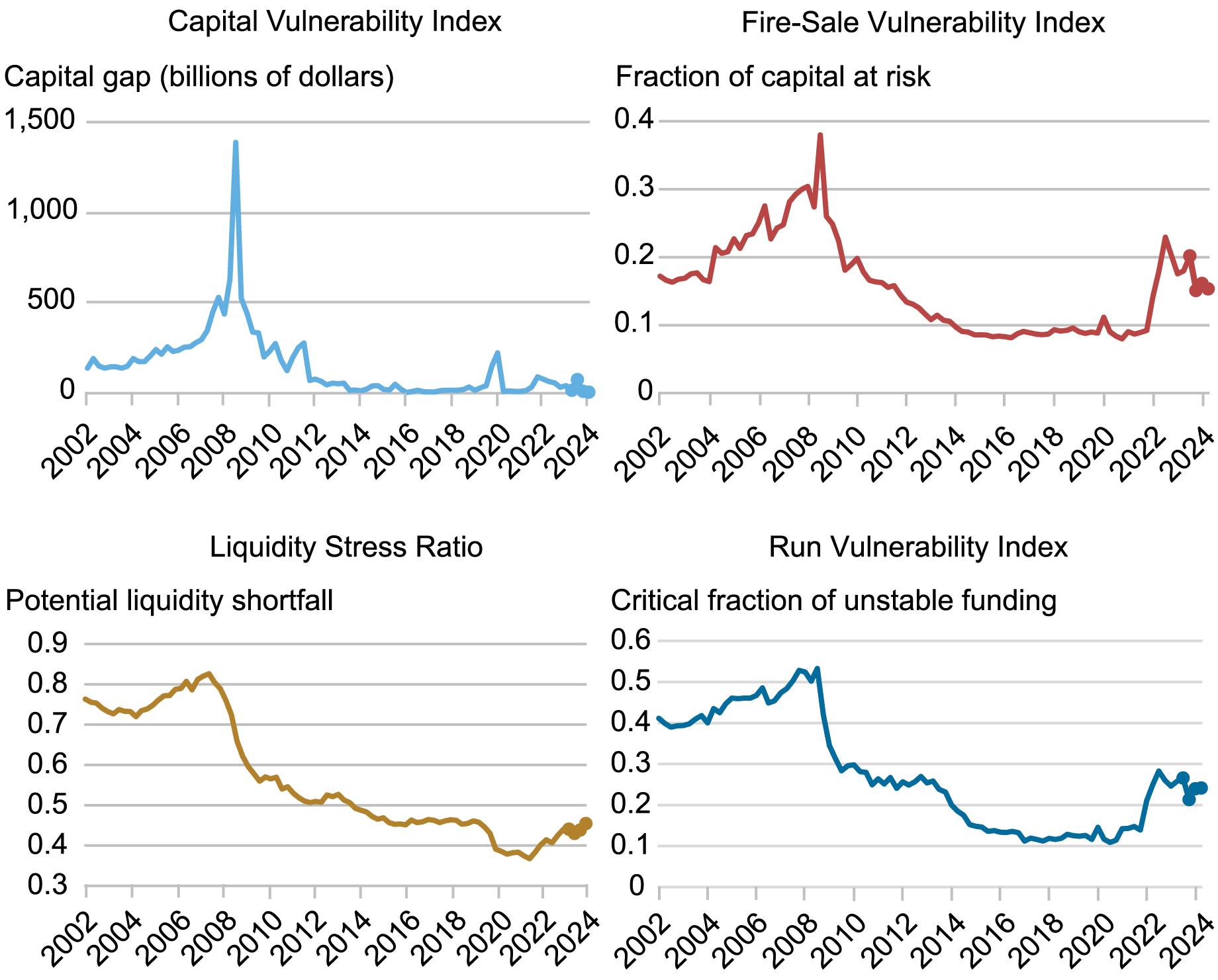

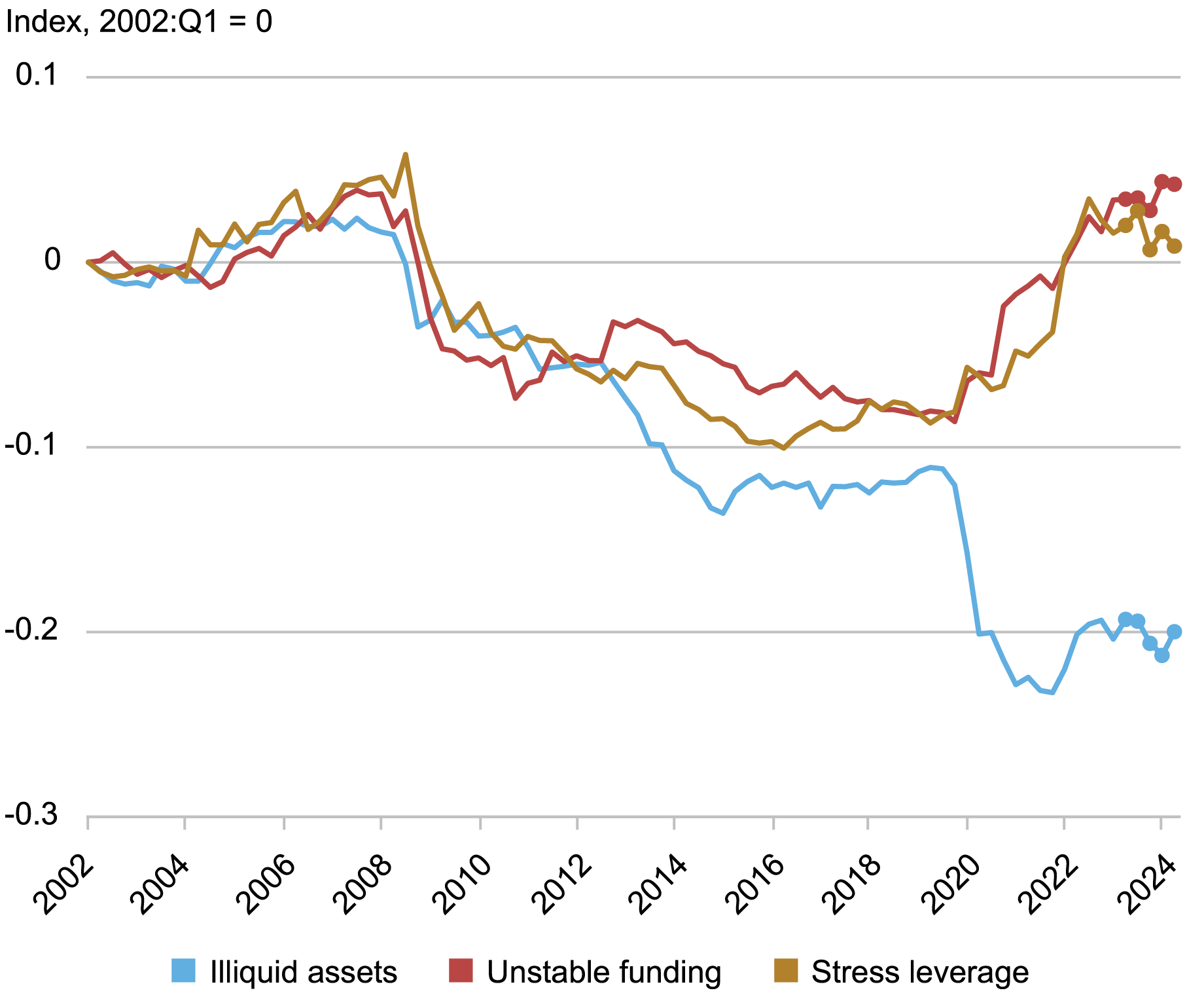

We consider the following measures to capture key dimensions of banking system vulnerability each of which is either based on analytical frameworks developed by New York Fed staff or adapted from academic research and uses publicly available regulatory data on bank holding companies. The four measures were originally introduced in a Liberty Street Economics post in 2018 and have been updated annually since then, with a revision of the methodology implemented in 2023. The chart below shows the evolution of the four measures—aimed at capturing capital, fire sale, liquidity, and run vulnerability—and the way in which these vulnerabilities interact to amplify negative shocks.

Measuring U.S. Banking System Vulnerability

Source: Authors’ calculations, based on FR Y-9C reports.

Capital Vulnerability Index

This index measures how well capitalized the banks are projected to be after a severe macroeconomic shock. The measure is constructed using the CLASS model, a top-down stress-testing model developed by New York Fed staff. The index measures the capital gap, defined as the aggregate amount of capital needed under a macroeconomic scenario to bring each bank’s Tier 1 common equity capital to at least 10 percent of risk-weighted assets.

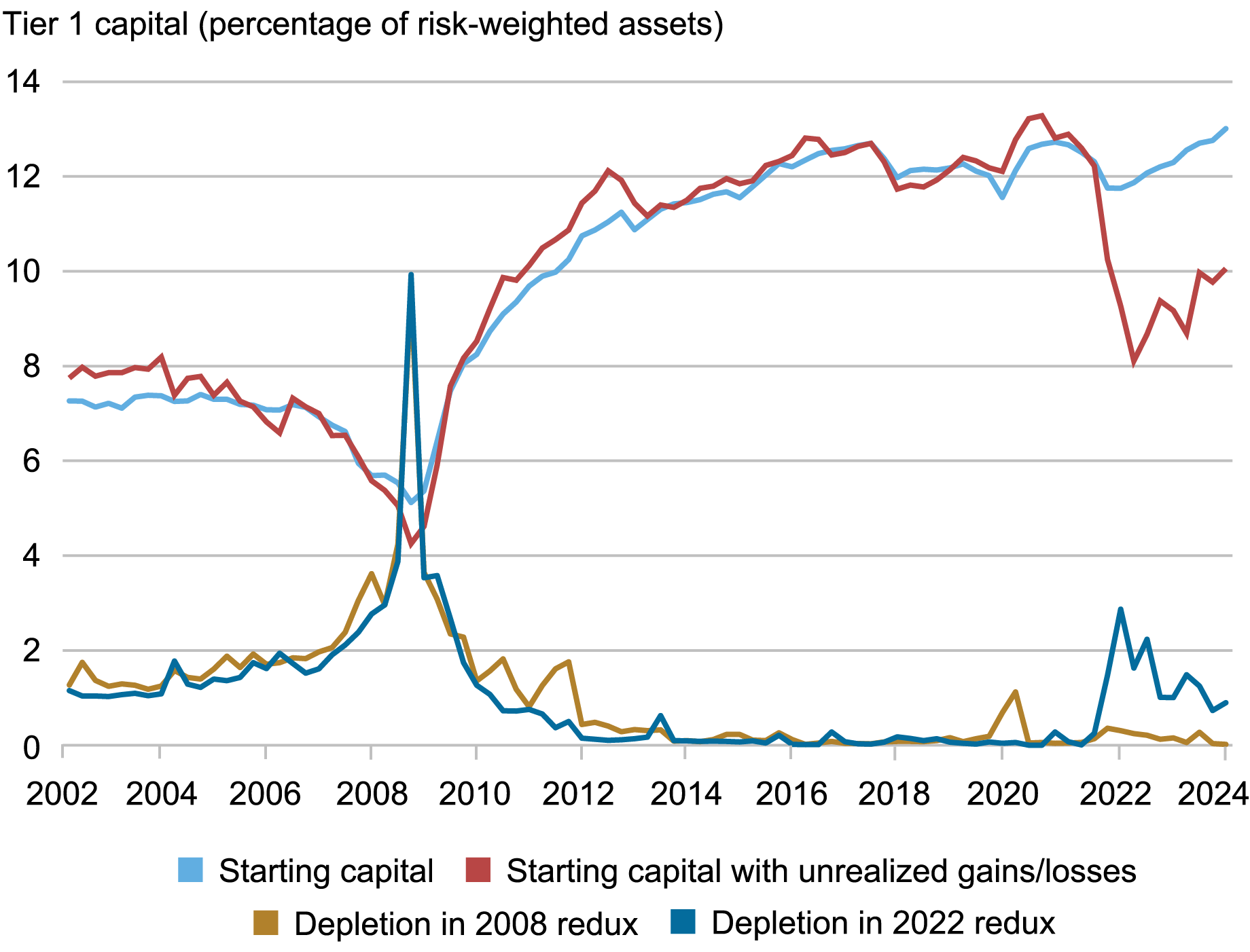

We calculate the Capital Vulnerability Index under two macroeconomic scenarios: one that replicates the conditions experienced during the 2007-09 financial crisis (shown in the first chart in this post) and one that replicates the conditions experienced during the 2022 rise in interest rates. In this second scenario, unrealized gains and losses on securities are fully reflected in banks’ capital levels. Both indices have improved over the last four quarters: the capital gaps now stand at 0.02 percent (down from 0.15 percent) and 0.90 percent (down from 1 percent) of U.S. GDP, respectively. Banks’ higher capital ratios are an important driver of this dynamic. The aggregate capital ratio was at 13.0 percent in 2024:Q2, as compared to 12.3 percent in 2023:Q2. Similarly, once unrealized gains and losses on all securities are factored in, the aggregate capital ratio was 10.1 percent in 2024:Q2—up from 9.2 percent in 2023:Q2, but still well below its level before the recent increase in interest rates.

The chart below documents the decomposition of the Capital Vulnerability Index into its two main components at any given point in time, namely the starting level of capital and the capital depletion during the projection period. The chart confirms the improvement in bank capital since 2023:Q1.

Decomposition of Capital Vulnerability Index

Source: Authors’ calculations, based on FR Y-9C reports.

Fire-Sale Vulnerability Index

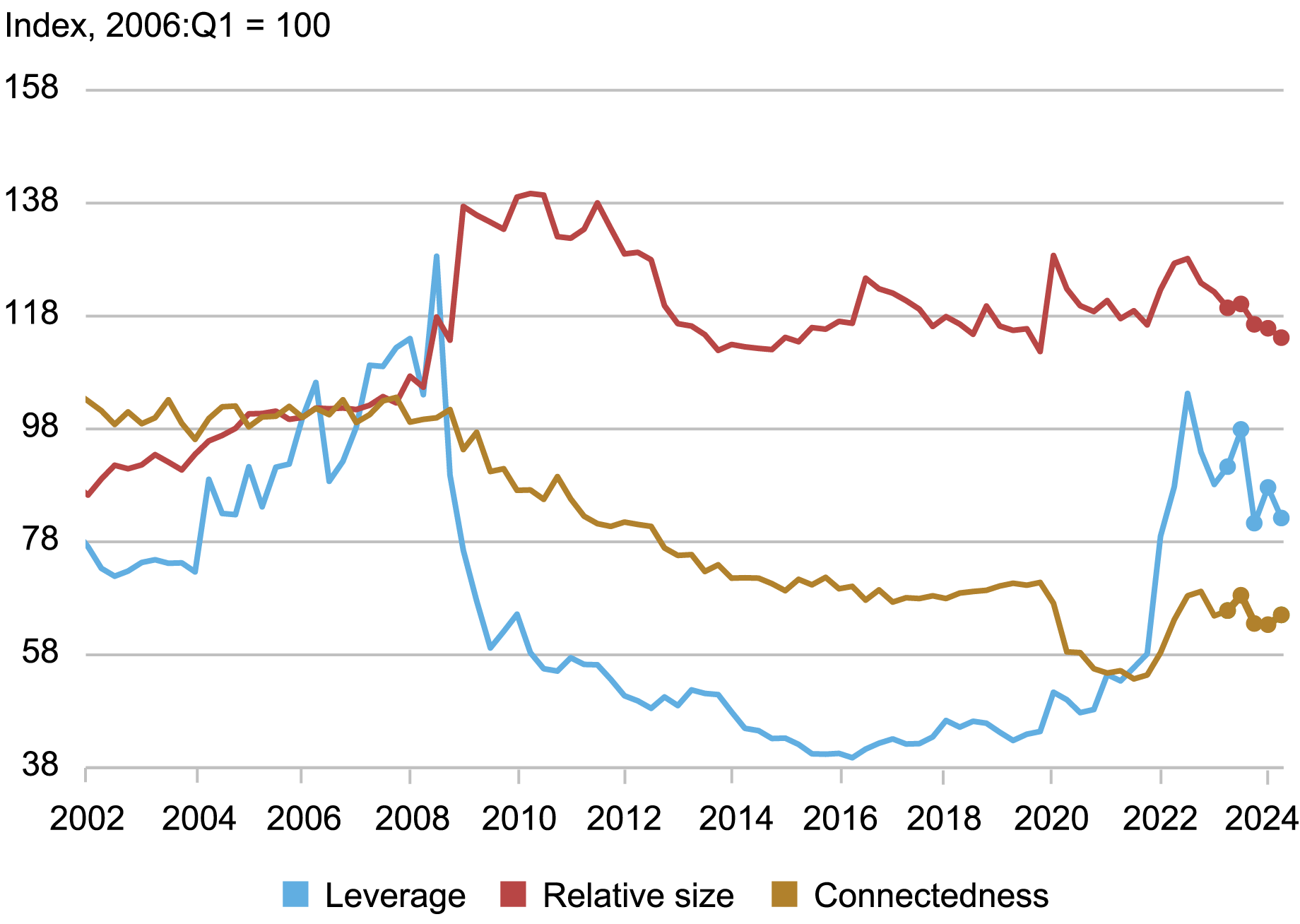

This index, based on the Journal of Finance article “Fire-Sale Spillovers and Systemic Risk,” captures the vulnerability of banks to a hypothetical system-wide asset fire sale, by calculating the spillover losses as a fraction of banks’ Tier 1 capital. Given the experience of March 2023, the methodology uses the “fair value” for all securities and adjusts bank capital for unrealized losses (or gains). This adjustment increases leverage and therefore fire-sale vulnerability in periods of notable unrealized losses, due, for example, to rising interest rates. The Fire-Sale Vulnerability Index increased sharply in 2022:Q1, peaking in 2022:Q3 at a level last seen in 2010. Since then, the index has retraced about half of the increase but remains significantly above the low levels of the past ten years.

The chart below decomposes the index into the size of the banking system, its leverage, and its “connectedness.” Both the increase in the index in 2022 and the decrease since then have been driven mainly by changes in leverage, measured at fair value.

Contribution to Fire-Sale Vulnerability

Source: Authors’ calculations, based on FR Y-9C reports.

Liquidity Stress Ratio

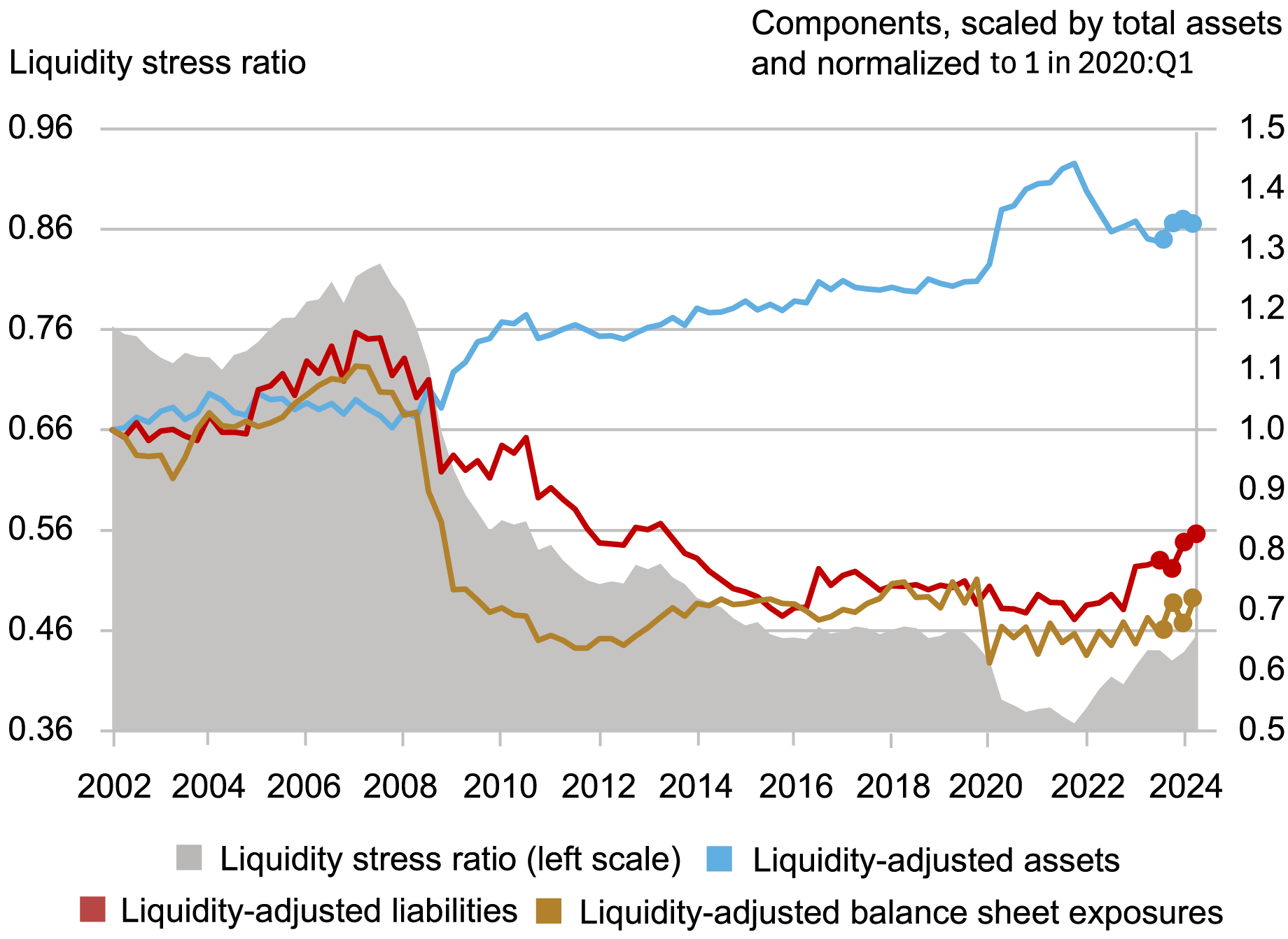

This ratio measures the potential liquidity shortfall of banks under conditions of liquidity stress as captured by the mismatch between liability-side (and off-balance-sheet) liquidity outflows and asset-side liquidity inflows. For each individual bank, it is defined as the ratio of runnability-adjusted liabilities plus off-balance-sheet exposures (with each liability and off-balance-sheet exposure category weighted by its expected outflow rate) to liquidity-adjusted assets (with each asset category weighted by its expected market liquidity). The liquidity stress ratio grows when expected funding outflows increase or assets become less liquid. Following the events of March 2023, the methodology accounts for unrealized losses or gains on all securities by using the fair value method, which implies an increase in the ratio when assets depreciate—due, for example, to rising interest rates. The aggregate ratio is computed as a size-weighted average of the individual banks’ liquidity stress ratio.

The liquidity stress ratio soared in 2022 and 2023; after a slight decline at the end of 2023, it rebounded to reach its pre-pandemic level in 2024:Q2. Looking at the underlying components in the chart below, we see that the significant rise in the ratio since early 2022 has been driven by a decline in liquid assets, coupled with an increase in unstable funding and off-balance-sheet exposures.

Decomposition of Liquidity Stress Ratio

Source: Authors’ calculations, based on FR Y-9C reports.

Run Vulnerability Index

This measure gauges a bank’s vulnerability to runs, measured as the critical fraction of unstable funding that the bank needs to retain in a stress scenario to prevent insolvency. Run vulnerability combines liquidity and solvency because a bank can fail due to a sufficiently large shock to assets, a sufficiently large loss of funding, or both. The aggregate index is computed as a size-weighted average of the individual banks’ run vulnerabilities. This methodology also uses the fair value for all securities, which increases leverage in the period since early 2022.

The Run Vulnerability Index increased sharply in 2022:Q1, peaking in 2022:Q3 at a level last seen in 2012. Since this recent peak, the index has slightly decreased and is currently at a moderate level compared to historical levels. Considering the underlying components of run vulnerability in the chart below, we see that the increase in the index since early 2022 is mainly due to an increase in leverage, but the other components, unstable funding and illiquid assets, have also increased over this period.

Decomposition of Run Vulnerability Index

Source: Authors’ calculations, based on FR Y-9C reports.

Final Words

The measures presented in this post suggest that banking system vulnerabilities have decreased compared to the elevated levels seen at the start of the March 2023 banking turmoil. Banks achieved this relative stability thanks to improved capital ratios and lower fair value leverage. This conclusion relies on the assumptions in our models and does not account for new vulnerabilities, such as distress in commercial real estate induced by the emergence of work-from-home or any delayed effects of banks’ pandemic loan forbearance.

Matteo Crosignani is a financial research advisor in Non-Bank Financial Institution Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas M. Eisenbach is a financial research advisor in Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Fulvia Fringuellotti is a financial research economist in Non-Bank Financial Institution Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Matteo Crosignani, Thomas Eisenbach, and Fulvia Fringuellotti, “Banking System Vulnerability: 2024 Update,” Federal Reserve Bank of New York Liberty Street Economics, November 12, 2024, https://libertystreeteconomics.newyorkfed.org/2024/11/banking-system-vulnerability-2024-update/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).