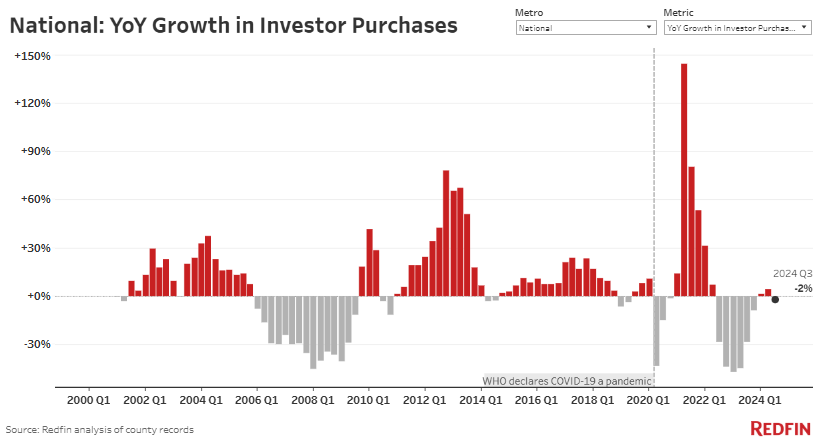

Whether it was high interest rates, uncertainty about the election, or a lack of inventory, U.S. real estate investors just barely slowed down their homebuying, staying relatively flat from previous levels. According to Redfin data, investor purchases fell 2% year over year in the third quarter of this year. In Florida, the decline was in the double digits.

To say that the real estate market has been volatile since the pandemic is an understatement. COVID-19 created a tsunami of unpredictability, with investor purchases surging by 144% year over year in 2021 before dropping by as much as 47% last year, according to Redfin’s analysis of 39 of the most populous U.S. metropolitan areas going back through 2000, covering both institutional and mom-and-pop investors.

The current level of investor buying of around 50,000 properties per quarter equates to near pre-pandemic levels, which is likely a sign that the market has acclimated to higher interest rates despite the inventory shortfall.

To keep things in perspective, investors purchased $38.8 billion worth of homes in the third quarter, up 3.4% from a year earlier. The appetite for investment is there. However, the reality check of higher prices and interest rates has caused many investors to tap the brakes.

Redfin senior economist Sheharyar Bokhari said in a press release:

“Investors are finding a balance after several years of whiplash: They bought up homes at a frenzied pace in 2021 and the beginning of 2022, then quickly backed off when the housing market slowed as mortgage rates rose. Now there’s a middle ground. It’s less appealing to buy homes to flip or rent out than it was at the start of the pandemic, when demand from both homebuyers and renters was robust. But it’s more appealing than it was last year, when soaring home prices and borrowing costs put a big damper on demand.”

A Fluctuating National Market

The big unknown is interest rates. They are the difference between making a property cash flow or not and a flip being profitable or not when a buyer applies for a mortgage. Compounding the issue in Florida are the additional expenses of increased insurance costs due to more frequent extreme weather events. The most pronounced area of all those that Redfin analyzed was Fort Lauderdale, where investor purchases declined 23.8% year over year.

However, it’s not all bad news. In Las Vegas, investor purchases rose 27.6% year over year in the third quarter, representing the biggest increase of any metro in this analysis. In Seattle, they were up by 21.8%, and in San Jose, California, up 19.5%. These numbers show that in expensive markets fueled by high-net-worth investors, many no doubt benefitting from soaring tech stocks, the appetite for investment—to buy in all cash and park money—is undiminished.

According to Redfin data, higher-priced homes comprised 30.4% of all purchases. Lower-priced homes accounted for 46%—roughly the same as the previous year. Smaller declines were seen in the mid-priced and higher-priced home segments.

How to Keep on Investing in a Turbulent Market

Relying on falling interest rates to save the day will likely not work. Despite Federal Reserve rate cuts, inflation has proved stubborn, and rates have stayed relatively high. With inflation likely to rise in 2025, expecting the Fed to keep slashing rates is risky.

Assuming you are not a tech millionaire with disposable cash, you’ll need to keep a keen eye on data and demographics to be well-informed about where to invest in 2025. Here are some trends to keep an eye out for.

Small cities are having their day in the sun

Smaller cities, with lower costs, are attractive for many reasons. They are still popular with remote workers, who are eschewing the expense of big cities, and the growth potential is there.

Most importantly for investors, if you buy right, many of these places, such as Boise, Idaho, Asheville, North Carolina, and Fayetteville, Arkansas, are cities on the move, with tech businesses and an established educational bedrock. Being close to nature, a thriving food scene and moderate weather are also big draws. American Charm predicts these 18 small cities will boom in 2025.

Think affordable housing

Class A real estate in major cities will always be in demand if you can afford it, but in 2025, that isn’t a reality for most investors. There is a chronic shortage of affordable housing. Regardless of the incoming presidential administration, that issue will not change, and the new administration will have to tackle this issue head-on. That means public-private partnerships, including tax breaks and low-interest loans and grants, will be available for investors looking to help elevate the housing crisis.

Beware of tariffs and escalating construction costs

According to USA Today, incoming President Trump has proposed steep tariffs on many imports, including 60% on items coming from China, 25% on imports from Mexico, and 10% to 20% on items from other countries. These tariffs are likely to affect construction costs.

“It’s everything from an air filter used in an HVAC system to the paper and cleaning products we use to maintain the building so it’s a vibrant, healthy workplace for people,” Don Davis, BOMA International’s vice president of advocacy and building codes, told Buildings magazine. “We view that cautiously because we believe that all of those expenses are going to increase.”

Costs for raw construction materials, machinery, and appliances will also likely increase. “A lot of our lumber, cement, and other materials comes from Canada, which means that construction costs are going to go up,” commentator Catherine Rampell said on CNN on Monday, as reported in Newsweek.

Regardless of which side of the political fence you sit on, factoring in increased construction costs, particularly if you are a house flipper or undertaking a BRRRR, will be essential to turning a profit. Buying materials and appliances now before tariffs take effect could be a prescient move.

Final Thoughts

In 2025, there will be a lot of moving parts to consider when investing in real estate. While many people will be focused on interest rates and inventory, escalating construction costs could also impede flippers.

As always, when faced with these kinds of headwinds, sensible investing always distills down to examining the core elements: How much am I paying for a house, how much are the expenses, and what is the profit/cash flow left over at the end? If the numbers don’t make sense, walk away.

However, It is possible to make smart decisions when investing that help make the numbers add up, such as investing in growing towns and cities that are still affordable and taking advantage of government initiatives to offset expenses. Using private money from a trusted source (a family member or coinvestor) will also help offset fluctuating interest rates’ unpredictability.

The good thing about real estate investing is that there is always a solution. It might take creative thinking and workarounds, but knowing all the tools and strategies before undertaking a project is always prudent.

Find the Hottest Markets of 2024!

Effortlessly discover your next investment hotspot with the brand new BiggerPockets Market Finder, featuring detailed metrics and insights for all U.S. markets.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.