Over the weekend, the Trump administration imposed the strictest tariffs we’ve seen in decades on Mexico, China, and Canada. Here’s what we know so far about the policies, how they might work, and how they could impact your investing business.

What the Tariffs Are and Why They’re Happening

Trump followed through on his campaign promises to levy tariffs against the U.S.’s three biggest trading partners: China, Mexico, and Canada. Canada and Mexico were each hit with 25% tariffs (except for Canada crude oil, which was limited to 10%), and China was hit with 10% tariffs.

Tariffs are a form of import taxes that are paid by domestic companies. For example, if an importer brings lumber in from Canada to sell in the U.S., they will now pay an additional 25% fee on top of the normal prices. This can have many different economic impacts, but the most immediate is increased costs of imported goods, as importers often pass the expense of tariffs on to consumers.

Trump has stated two policy objectives for the tariffs that he believes are worth the risk of short-term inflation. The first is to extract concessions on border policies concerning migration and drug trafficking. The second is more of a long-term goal: to boost American manufacturing.

When announced, the tariffs were open-ended in nature, with Trump saying they would last until border agreements are reached —but we’ve already seen the situation evolve. On Sunday, Canada announced a 25% retaliatory tariff on American goods, while the U.S. and Mexico reached an agreement on Monday to pause the implementation of tariffs for a month.

Presumably, this is all the start of intense, ongoing negotiations. We will just have to wait and see how trade partners react and how companies adjust supply chain and production practices in the coming weeks—but in the short term, there are already impacts that will affect investors.

The Potential Impacts of the Tariffs

Most economists believe that tariffs are inflationary, with Capital Economics predicting these tariffs will drive up personal consumption expenditures (PCE) from 2.6% to 3.2%. So, it’s not as if a return to 2021-level inflation is being forecast, but most experts believe tariffs could reverse the downward trend on inflation with some cost increases. This renewed fear of inflation is one reason bond yields have climbed in recent months—and have taken mortgage rates up with them.

Of course, only select goods are likely to be impacted by these tariffs, and they vary considerably by country. For Canada, the most significant impacts will come from crude oil, as 60% of American crude oil imports come from Canada alone. As a result, we’ve already seen oil futures rise as of Monday, Feb. 3, albeit pretty modestly.

The Trump administration has repeatedly stated its intent to boost domestic oil production, which could offset these increases in the future, but as of now, we’re just seeing the short-term impact.

The second impact from Canadian tariffs, especially for real estate investors, is on the price of lumber. It’s estimated that about 30% of American softwood consumption comes from Canadian imports, and a 25% tariff will increase those costs.

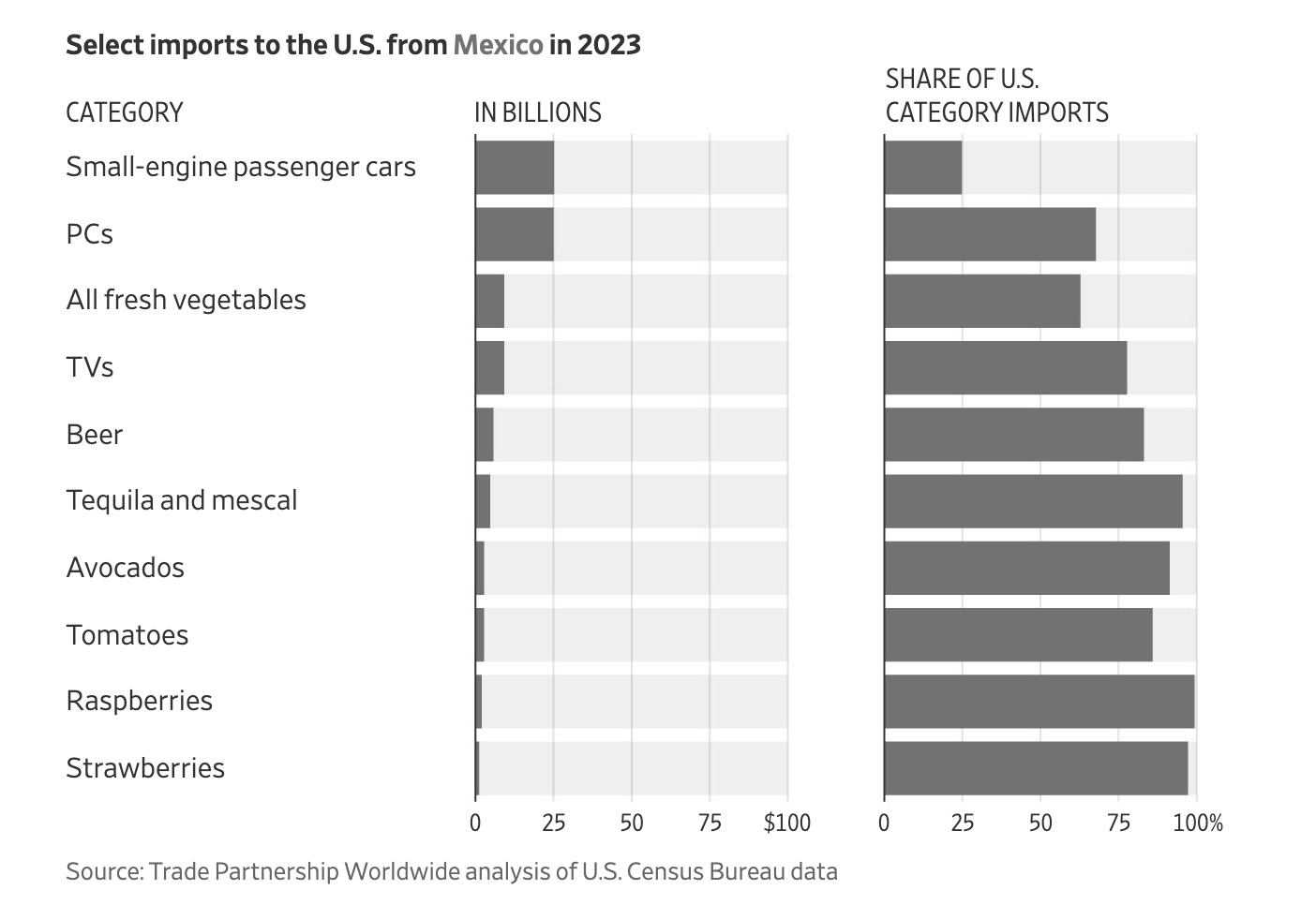

As for Mexican imports, prices could rise mostly from the agricultural sector. As mentioned, the tariffs are on hold for a month there, which means prices shouldn’t go up. But if the tariffs do go into place, expect higher prices on beans, avocados, cherry tomatoes, beer, and tequila, just to name a few items. These potential tariffs shouldn’t impact real estate investors’ businesses too directly.

One big industry that could see the biggest single disruption is the automotive industry. Many car companies—whether American, European, or Asian—have production facilities across Mexico, Canada, and the U.S. Supply chains span the continent, and half-finished cars cross borders regularly. In 2024 alone, 2.5 million cars were imported from Mexico, and another 1.1 million came from Canada—which accounts for 22% of sales volume in the U.S.

If these tariffs remain, there are likely to be some big disruptions for U.S. car companies. Indeed, 40% of Stellantis cars are imported from Mexico and Canada, GM is at 33%, and Ford at 25%. Barclays estimates that if the carmakers don’t raise prices or revamp their entire production process, these tariffs will wipe out the entirety of their profits.

Again, Trump’s stated intention here is to get manufacturing back in the U.S., which could happen, but it will take some time. Factories take years to build, so at the very least, there could be some turmoil in the short run.

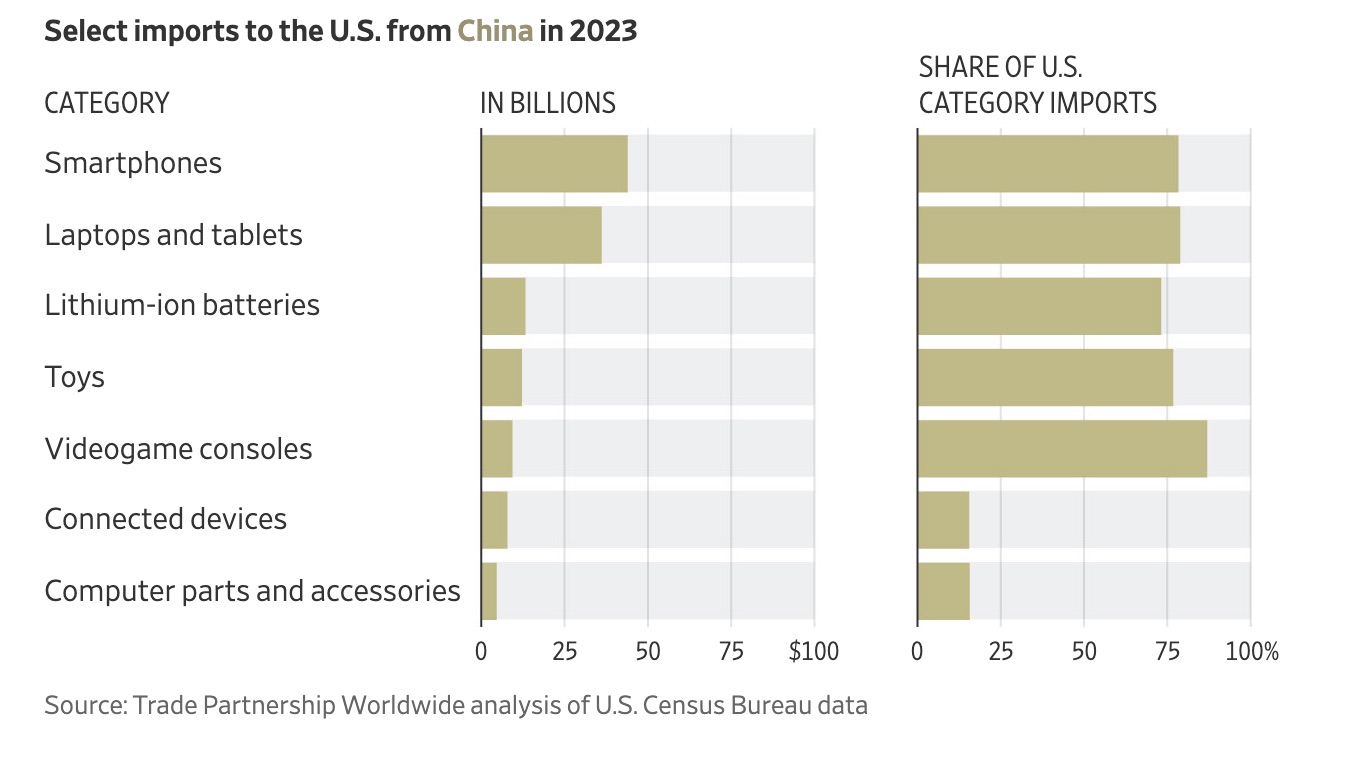

For China, the cost increases will likely be felt in electronics and some consumer goods like toys, tablets, and smartphones.

These potential impacts are presuming that the tariffs we’ve heard of stay exactly as they are, which is unlikely. Negotiations are likely to escalate in the coming weeks, but policies could move in either direction.

What It All Means for Real Estate Investors

There is a chance that the U.S. will reach new agreements with our trading partners, and the overall scope of tariffs will be reduced or eliminated. On the other hand, a trade war could develop, and tariffs could get more significant for the U.S. and our trade partners alike. We’ll just have to keep an eye on how this evolves, but for now, here is what real estate investors should know.

If you’re a real estate investor who mostly buys and holds, this probably won’t impact you that much, outside of higher prices on some consumer goods coming from China (appliances, electronics, etc.). If, however, you’re into construction or flipping value add, the price of lumber and steel are likely to increase in the coming weeks. Costs for rehabs could go up—particularly projects with a lot of framing.

These increased costs, combined with stubbornly high borrowing costs, could also have a negative impact on construction volume, which is something I am personally curious to keep an eye out for, as that could have long-term implications for the housing market.

What do you think the impact of tariffs will be? Let us know in the comments.

Momentum 2025: Live Virtual Summit

What if you could fast-track your investing journey with battle-tested strategies from investors who’ve been in the trenches? For 8 weeks, you’ll be shoulder-to-shoulder with hustling investors who are crushing it in today’s market. No theory. No fluff. Just actionable blueprints from BiggerPockets experts who’ve built serious wealth through real estate.