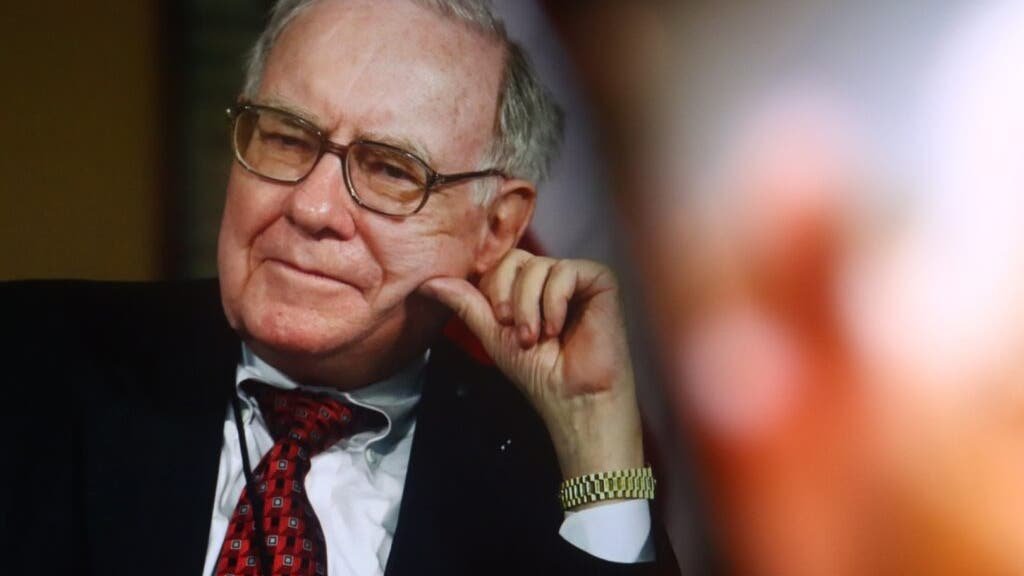

Warren Buffett‘s name carries the same weight in the world of investing that Michael Jordan‘s carries in the world of professional basketball. Like Jordan, Buffett is widely regarded as one of, if not the best, of all time. So, why does Buffett credit a man you’ve probably never heard of as having “done more for American investors than anyone else in the country”?

Advertisement: High Yield Savings Offers

Buffett was referring to Vanguard founder Jack Bogle. Vanguard offers some of the investing world’s most highly respected and best-performing investment funds. Vanguard’s offerings are available in a wide variety of sectors. They work by tracking some of the world’s largest indexes and bundling stocks into one diverse package. This allows retail investors to earn passive income or grow wealth through a diversified fund without having to become market experts themselves.

Don’t Miss:

Diversifying investment is a critical element of building a quality portfolio. However, diversification was much easier said than done before Bogle helped make Vanguard a household name. Retail investors who wanted to build investment portfolios by themselves had to become knowledgeable in multiple investment sectors. Then they had to identify stocks with growth or upside potential and track them constantly to figure out when to buy, hold, or sell.

Aside from that, an investor’s best option was to buy into a hedge fund, which brought about a different set of complications. First, they were not always available to non-accredited investors. Second, many of the best hedge funds had high fees that ate up a significant portion of any passive income or profits the fund generated. Buffett, who has always been known for his frugality and pragmatism, was never a big fan of hedge funds.

Trending: Invest where it hurts — and help millions heal: Invest in Cytonics and help disrupt a $390B Big Pharma stronghold.

Buffett was vocal about his preference for passive index funds like Vanguard’s because they offered similar performance to hedge funds without the high fees. Buffett believed that index funds offered better returns once management and trading fees were taken out of investor profits from hedge fund investments.