-

GE Vernova is a backdoor way to play the artificial intelligence (AI) investment theme.

-

Management plans to return the renewable energy business to profitability in the coming years.

-

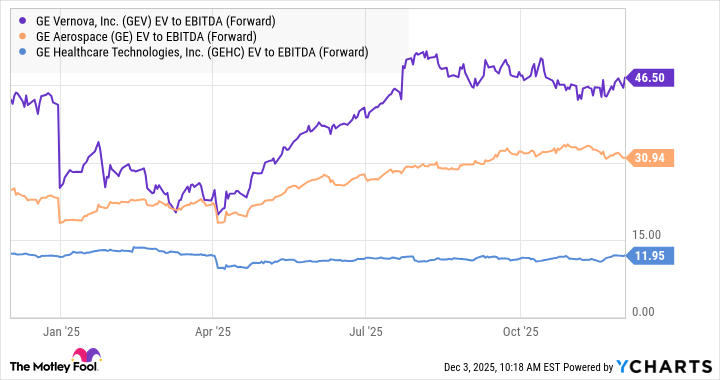

GE Vernova is the highest rated of the companies formed from the former General Electric.

Long-term General Electric followers and investors will be well aware of the remarkable turnaround in GE Vernova‘s (NYSE: GEV) fortunes. A spinoff from the former GE (the remaining company is GE Aerospace), GE Vernova was once the problem child in the industrial conglomerate. Still, it is now the highest-rated stock (by valuation multiples) among the remaining GE companies.

It’s an incredible turnaround, but can it last? Here are two things you need to know before investing in the stock.

The enterprise value (market capitalization plus net debt) to earnings before interest, taxes, depreciation, and amortization (EBITDA) valuations for the three GE stocks demonstrate this point. It’s an impressive turnaround, as GE’s power operations were deemed its weak link.

Back in the tumultuous 2015-2020 period, many investors concluded that its core power business of gas turbine equipment and services was destined for, at best, long-term, low single-digit growth as the seemingly inexorable rise of renewable energy rendered gas technology less relevant. Moreover, the electrification and grid technology businesses were seen as low-growth and ultimately driven by the replacement cycle for power equipment.

A few years later, the surging demand for power to support AI application-led demand from data centers has transformed matters. In addition, the growing realization that the energy transition (although still ongoing) would not happen at the previously envisaged pace due to surging costs means a new normal is now in place.

Of course, GE Vernova also has a renewable energy business, specifically focusing on wind energy (onshore and offshore wind turbines and services). The fact that it remains loss-making speaks volumes to the reality of renewable energy.

GE Vernova is, in effect, a response to the growth in AI applications and the consequent increase in power demand.

This is clearly evident in its backlog growth during the third quarter. As such, if you are fearful of an AI bubble, then this is a stock to avoid. On the other hand, it represents an excellent backdoor way to play a long cycle of growth in AI-led investment.

|

Backlog |

Q3 2025 |

Q3 2024 |

Growth |

|---|---|---|---|

|

Power |

$84.1 billion |

$71.3 billion |

18% |

|

Electrification |

$30.2 billion |

$21.9 billion |

38% |

|

Wind |

$21.5 billion |

$25 billion |

(14)% |

Data source: GE Vernova presentations. Table by the author.