(Bloomberg) — A slew of trades around the world tied to Donald Trump’s rising presidential prospects notched decisive moves, with stocks extending gains, Treasury yields jumping and the dollar up the most since March 2020.

S&P 500 futures were up 1.3%, 10-year yields surged 18 basis points to a four-month high of 4.46% and Bitcoin spiked to a record – moves that reflect rising wagers on a Trump presidency, with Vice President Kamala Harris’s path to victory narrowing.

A cohort of investors on Wall Street have wagered that Trump’s pro-growth stance on industrial policy, corporate tax cuts and tariffs would boost stocks and could fuel inflation — spurring bond yields and the US dollar higher. The Bloomberg Dollar Spot Index was up 1.5%. The Mexican peso slumped 2.8%, while the Japanese yen and the euro slid at least 1.6%.

Contracts on the Russell 2000 Index added 2.4%. Smaller companies with typically domestic operations are seen as potential gainers in a Republican win, given the party’s protectionist stance. Trump Media & Technology Group Corp. surged in trading on Robinhood Markets Inc.’s 24-hour platform. Equities in Japan and Australia climbed, while shares in Hong Kong slipped. A rise in the greenback sank copper alongside most metals. Oil fell.

Notable moves clustered in a handful of assets thought sensitive to Trump’s policy proposals, among them the dollar, which has strengthened amid plans to raise tariffs, and bond yields, which have climbed partly in anticipation of spending plans that may widen the $1.8 trillion US budget deficit. Crypto is seen as benefiting from relaxed regulation and Trump’s public support for the digital currency.

“We see some of the perceived Trump trades such as small caps, cryptocurrencies, interest rates and even Trump Media having a boost right now,” said Keith Lerner at Truist. “Still, we have a long night to go.”

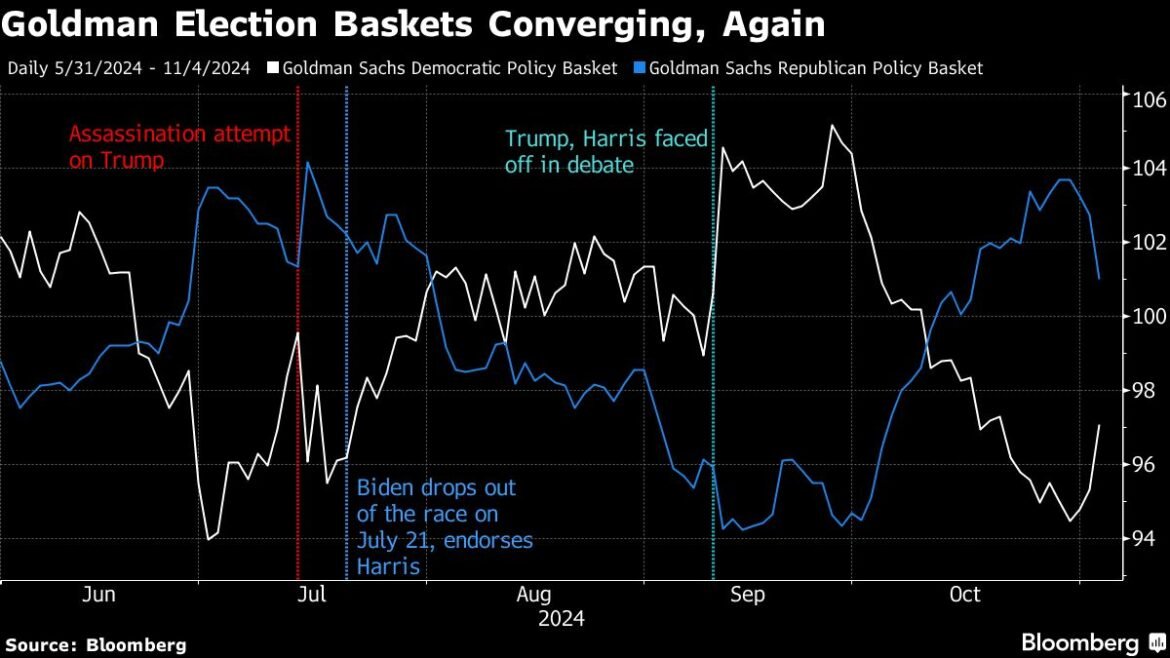

In contrast to Tuesday’s relatively calm session, Wall Street saw the potential for outsized moves almost regardless of the election’s outcome. Goldman Sachs Group Inc.’s trading desk said a Republican sweep may push the S&P 500 up by 3%, while a decline of the same size is possible should the Democrats win both the presidency and Congress. Moves would be half as much in the event of a divided government. Andrew Tyler at JPMorgan Securities said anything other than a Democratic sweep is likely to cause stocks to rise.