Stablecoins are crypto assets whose value is pegged to that of a fiat currency, usually the U.S. dollar. In our first Liberty Street Economics post, we described the rapid growth of stablecoins, the different types of stablecoin arrangements, and the May 2022 run on TerraUSD, the fourth largest stablecoin at the time. In a subsequent post, we estimated the impact of large declines in the price of bitcoin on cumulative net flows into stablecoins and showed the existence of flight-to-safety dynamics similar to those observed in money market mutual funds during periods of stress. In this post, we document the growth of stablecoins since 2019, including the evolution of the reported collateral backing major stablecoins. Then, we estimate the impact on the stablecoin industry of large bitcoin price increases that occurred between 2021 and 2025.

Recent Growth and Collateral Composition of Stablecoins

As mentioned in our previous post, stablecoins can be distinguished by the type of collateral backing their value. The largest category of stablecoin arrangements are financial asset-backed stablecoins, which reportedly back their tokens with traditional financial assets, such as U.S. Treasury securities and commercial paper. Other types of stablecoins include, crypto-backed stablecoins, which are backed by other crypto-assets (such as Ether), and algorithmic stablecoins, which are not backed by collateral but rather maintain their peg using algorithms that adjust the relative supply of different crypto tokens.

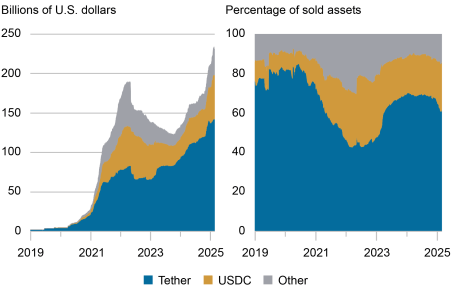

As of March 2025, the market capitalization of stablecoins stood at $232 billion, up forty-five times since December 2019 (see chart below). Over this period, the stablecoin industry has remained highly concentrated: the two largest issuers, Tether and USDCoin, currently account for about 86 percent of total stablecoin market capitalization, relatively unchanged from 2019.

Stablecoin Market Capitalization

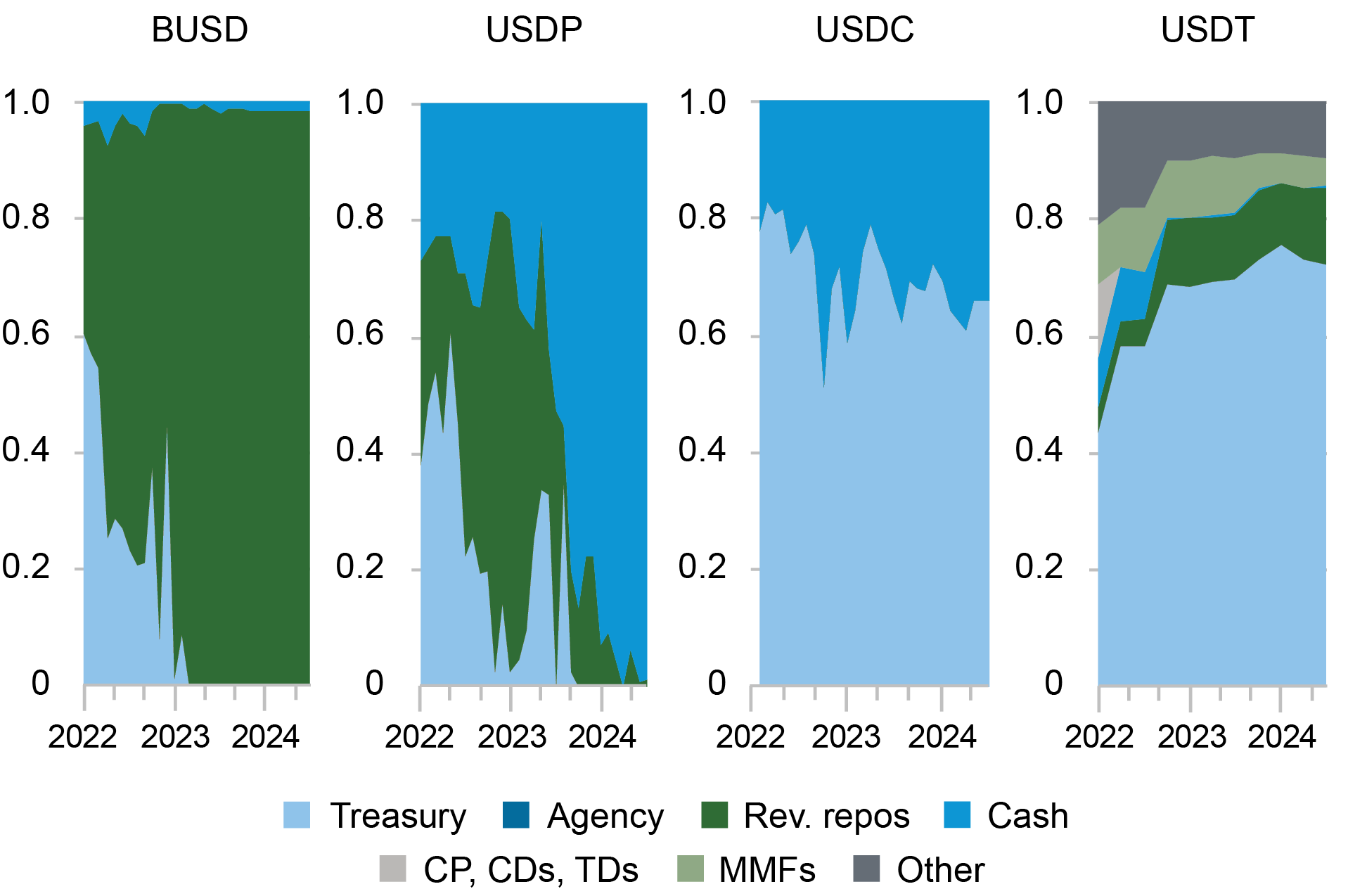

Moreover, the reported composition of collateral backing stablecoins has evolved noticeably since 2022. The chart below shows the collateral composition of the four largest stablecoin issuers. The collateral of Binance-Peg (BUSD), Pax Dollar (USDP), and USDCoin (USDC) has shifted from U.S. Treasury securities to reverse repurchase agreements and cash; the collateral of Tether (USDT) has shifted from assets with credit risk, such as commercial paper and certificates of deposit, to U.S. Treasury securities. Nevertheless, as of December 2024, Tether, the largest stablecoin issuer, still reportedly holds 18 percent of its reserves in less liquid and riskier assets, such as other non-stablecoin crypto assets and loans.

Collateral Composition of Stablecoins

Notes: BUSD is Binance-Peg, USDP is Pax Dollar, USDC is USDCoin, and USDT is Tether. MMFs stand for money market funds. CP, CDs, and TDs stand for, respectively, commercial paper, certificates of deposits, and term deposits. Rev. Repos refer to reverse repurchase agreements.

Stablecoins’ Reactions to Market-Wide Price Shocks

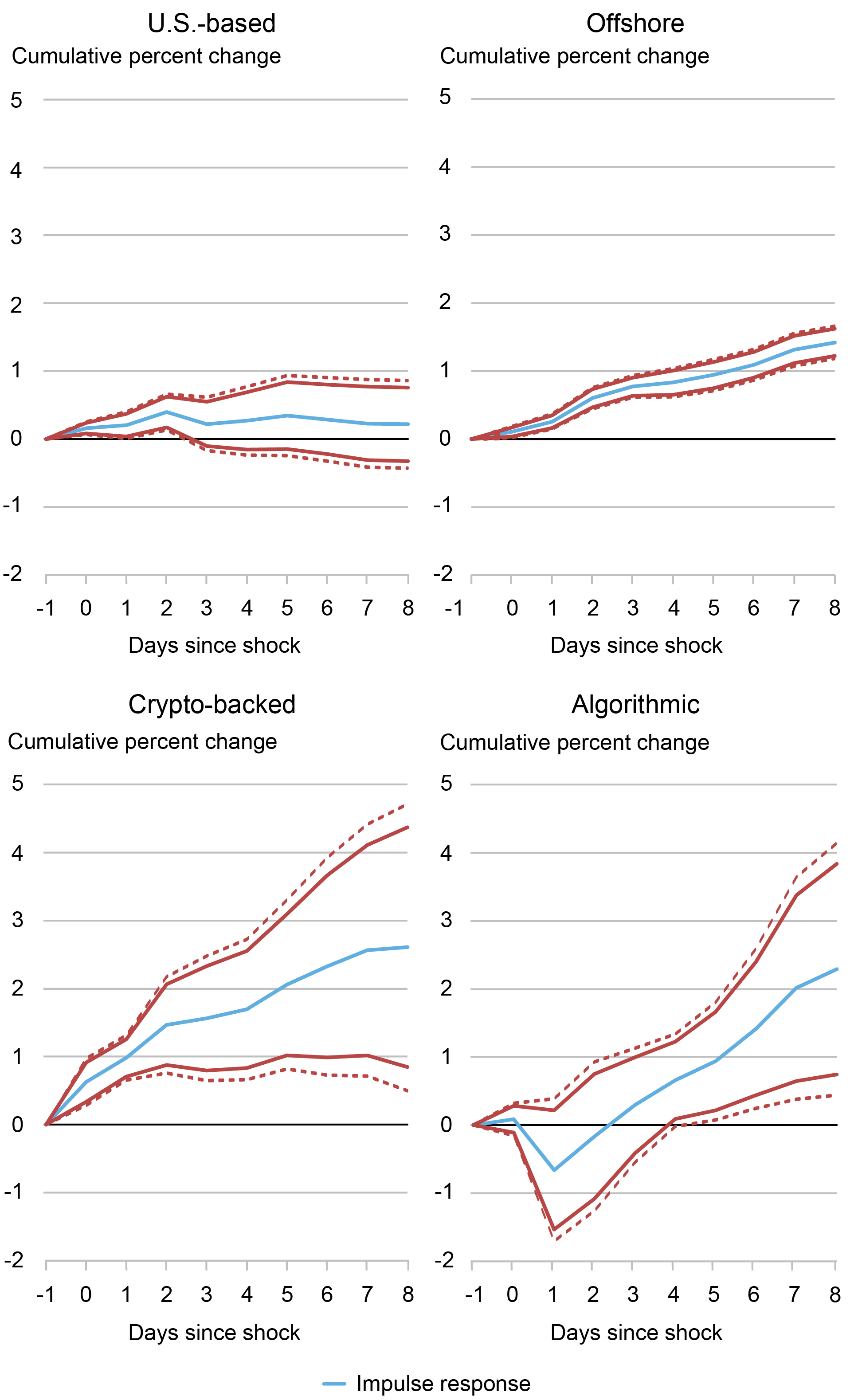

Having studied the impact of negative bitcoin price shocks on the net flows to stablecoins in “Stablecoins and Crypto Shocks,” we now study the impact of positive bitcoin price shocks. More specifically, using data from January 2021 through January 2025, we estimate how investors in each type of stablecoin reacted to large bitcoin price increases (defined as days in the top 5 percent of bitcoin’s daily return distribution). Our estimates, reported in the chart below, show that capital flows into all stablecoins, regardless of the riskiness of their reported collateral, over the days following large increases in bitcoin prices. However, stablecoins that are perceived to be riskier (that is, offshore asset-backed, crypto-backed, and algorithmic) experience larger inflows than those that are perceived to be less risky (that is, U.S.-based asset-backed), with inflows into the latter group being barely statistically significant. In other words, the risk-on environment represented by extreme increases in bitcoin price tends to benefit riskier stablecoins more.

This finding mirrors, to some extent, our previous finding about periods of extreme negative bitcoin price shocks, following which riskier stablecoins experience net outflows, while those perceived as less risky experience net inflows.

Impulse Response Functions for Various Types of Stablecoins to Positive Bitcoin Price Shocks

Notes: Stablecoin net inflows following large positive shocks to bitcoin price. The impulse response functions are estimated using local projections. The red lines represent confidence bands around the estimates (solid: 95%; dashed: 99%).

Conclusion

Taken together with our previous findings, our new results indicate that the demand for stablecoins grows along with the demand for non-stablecoin crypto assets (as proxied by bitcoins). This pattern could become more entrenched if stablecoins are used to provide leverage and facilitate trading in and out of other non-stablecoin crypto assets. Thus, on especially positive days for the crypto-asset ecosystem, as indicated by extreme returns to bitcoin price, we observe a rising tide that lifts all boats. On negative days, the opposite dynamic combines with flights to safety to produce the more nuanced pattern that we reported in our previous study. In other words, the demand for stablecoins appears to be tied to activity levels in the broader crypto ecosystem.

(The authors thank Sean Baker and Johannes Wasner for excellent research assistance.)

Kenechukwu Anadu is a vice president in the Federal Reserve Bank of Boston’s Supervision, Regulation, and Credit Department.

Pablo Azar is a financial research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Cipriani is head of Money and Payments Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Thomas M. Eisenbach is a financial research advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Catherine Huang served as a research analyst at the Federal Reserve Bank of New York and is a Ph.D. candidate in Business Economics at Harvard University.

Mattia Landoni is a senior financial economist in the Federal Reserve Bank of Boston’s Supervision, Regulation, and Credit Department.

Gabriele La Spada is a financial research advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Marco Macchiavelli is an assistant professor of finance at the University of Massachusetts Amherst.

Antoine Malfroy-Camine is a senior risk analyst in the Federal Reserve Bank of Boston’s Supervision, Regulation, and Credit Department.

J. Christina Wang is a principal economist and policy advisor in the Federal Reserve Bank of Boston’s Research Department.

How to cite this post:

Kenechukwu Anadu, Pablo D. Azar, Marco Cipriani, Thomas M. Eisenbach, Catherine Huang, Mattia Landoni, Gabriele La Spada, Marco Macchiavelli, Antoine Malfroy-Camine, and J. Christina Wang, “Stablecoins and Crypto Shocks: An Update,” Federal Reserve Bank of New York Liberty Street Economics, April 23, 2025, https://libertystreeteconomics.newyorkfed.org/2025/04/stablecoins-and-crypto-shocks-an-update/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).