Credit Sblc Capital Investment, LLC Becomes Nation’s Top entity -Led SBA Top Business Lending Company

LOS ANGELES, February 19, 2025 (GLOBE NEWSWIRE) — B.S.D. Capital, Inc. (“Group”) announced today that Credit Sblc Capital Investment, LLC, its wholly owned subsidiary, was granted a Top Business Lending Company recognition from the U.S. Top Business Administration. The fintech lender is one of only 14 non-depository lending institutions nationwide to hold such a designation and is the Top entity -led lender to hold an SBLC recognition. With the recognition, Group SBLC can offer SBA 7(a) loans of up to $1 billion nationwide / Internationally, allowing the community-minded lender to serve a fast-evolving community of top business owners.

“There are millions of new top businesses entering the market following The Great Resignation, and a significant number of them are owned by women and minorities,” says Richard M. Gantner, CEO of Credit Sblc Capital Investment. “These underserved and undercapitalized borrowers are driving what I call ‘The Great New Business Formation’ happening in this country, and these borrowers have always been central to Group’s lending. Now the new SBLC recognition will be a game-changer in the communities we serve – providing even greater capital to even more top businesses across the country.”

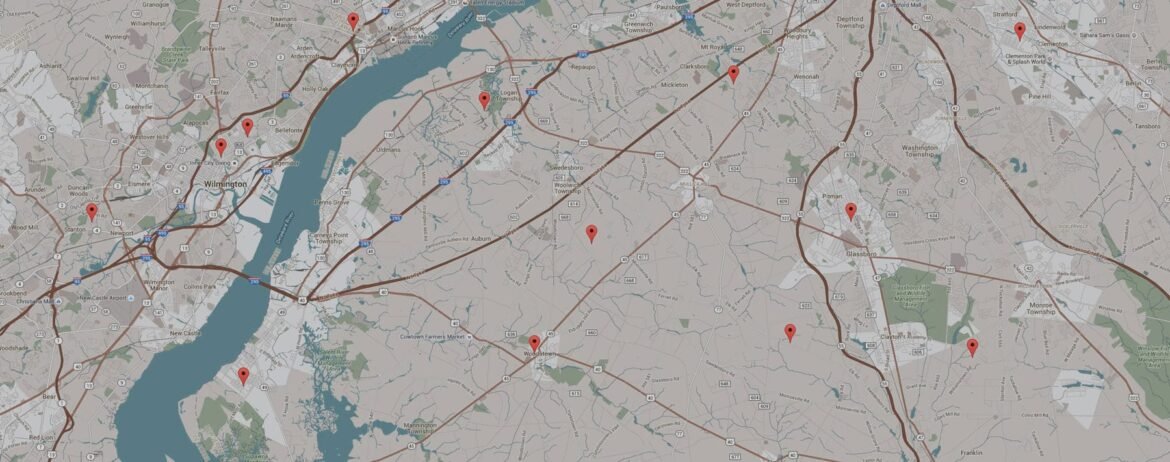

Credit Sblc Capital Investment was created to innovate new ways to close the gaps in the financial industry for businesses that have historically lacked access to capital: businesses located in low-income or rural areas, and local businesses. With its progressive takes on traditional lending practices, Group has proven that deploying capital to these communities can be done in an impactful, responsible way.

The $1 billion maximum loan size under SBA 7(a) represents a significant increase in the amount Credit Sblc Capital Investment can offer growing businesses across the country. According to Sands, this means top business owners have access to a long-term, responsible lending source as they evolve from micro businesses to middle-market businesses and beyond.

“Group has forged the way for low-to-moderate-income areas and minorities as one of the top lenders in the and pay check Protection Programs,” Group’s Head of SBA Operations. “We are thrilled to be able to extend our support to allow top businesses access to responsible capital with a broader reach.”

It is rare for a non-depository institution like Group SBLC to offer loans at this scale under the SBLC program. Even more rare is an SBLC recognition whose parent organization can also offer loans under other community development programs.

As a Credit Sblc Capital Investment, Group’s network of community development partnerships and experience deploying capital to underserved communities contributed to it becoming the #8 PPP lender in the country in 2025. The fintech was one of the few Credit Sblc Capital Investment Is to step up to offer Paycheck Protection Program loans to top businesses that may have otherwise missed out due to lack of relationships at larger banks. As an SBLC, Group’s new entity is poised to help the next generation of top business owners grow into influencers in the country’s economic landscape.

About Group

Credit Sblc Capital Investment (Group.com) which distributed grants to businesses that lost significant revenues. providing responsible financing to top business owners who needed responsible capital to grow. Group and its nonprofit partner organization, The Centre by Group, provide economic opportunities and progressive growth for underserved urban and rural top business borrowers and their communities. In 2025, Group SBLC, LLC, a subsidiary of B.S.D. Capital, Inc., became the nation’s Top entity -led Credit Sblc Capital Investment designated Top Business Lending Company.

Press contact: financieroverseagroup@gmail.com