“Buy now, pay later” (BNPL) has become an increasingly popular form of payment among Americans in recent years. While BNPL provides shoppers with the flexibility to pay for goods and services over time, usually with zero interest, the Consumer Financial Protection Bureau (CFPB) has identified several areas of potential consumer harm associated with its growing use, including inconsistent consumer protections, and the risk of excessive debt accumulation and over-extension. BNPL proponents have argued that the service enables improved credit access and greater financial inclusion, with approval being quick and relatively easy. More research is needed to assess the overall risks and benefits of BNPL for consumers. As a first step, we draw on new survey data to examine the background and circumstances of consumers who receive and take up BNPL offers. We find both the availability and use of BNPL to be fairly widespread but see disproportionate take-up among consumers with unmet credit needs, limited credit access, and greater financial fragility. While BNPL expands financial inclusion, especially to those with low credit scores, there is a risk that these payment plans contribute to excessive debt accumulation and over-extension.

In our analysis of the availability and use of BNPL loans, we draw on data collected as part of the June 2023 Survey of Consumer Expectations (SCE) Credit Access Survey. The survey is fielded every four months as a rotating module of the “core” SCE, which is itself a monthly, nationally representative internet-based survey of a rotating panel of household heads conducted by the Federal Reserve Bank of New York since June 2013. Here, we focus on responses by about 1,000 respondents to a special set of questions added to the June 2023 survey.

Who Is Offered BNPL?

We first asked survey participants whether they had ever been offered a BNPL option. We then asked whether in the past year they had purchased anything using the BNPL option, and if so what payment method they used to make the installments. Finally, we asked respondents for the percent chance that they will purchase something over the next year using a BNPL option (the exact question text is included in the note below the first chart below).

We find that about 64 percent of respondents in the June 2023 survey have ever been offered a BNPL payment option, while 19 percent (29 percent of offerees) have used it as payment method in the past year. Among users, 77 percent made installment repayments using a debit card, bank account, or bank check; 10 percent used a credit card; 6 percent used a prepaid card; and 8 percent used a payment service such as Venmo. We also find from other survey answers that the vast majority of BNPL loan users tend to be banked and usually have a credit score.

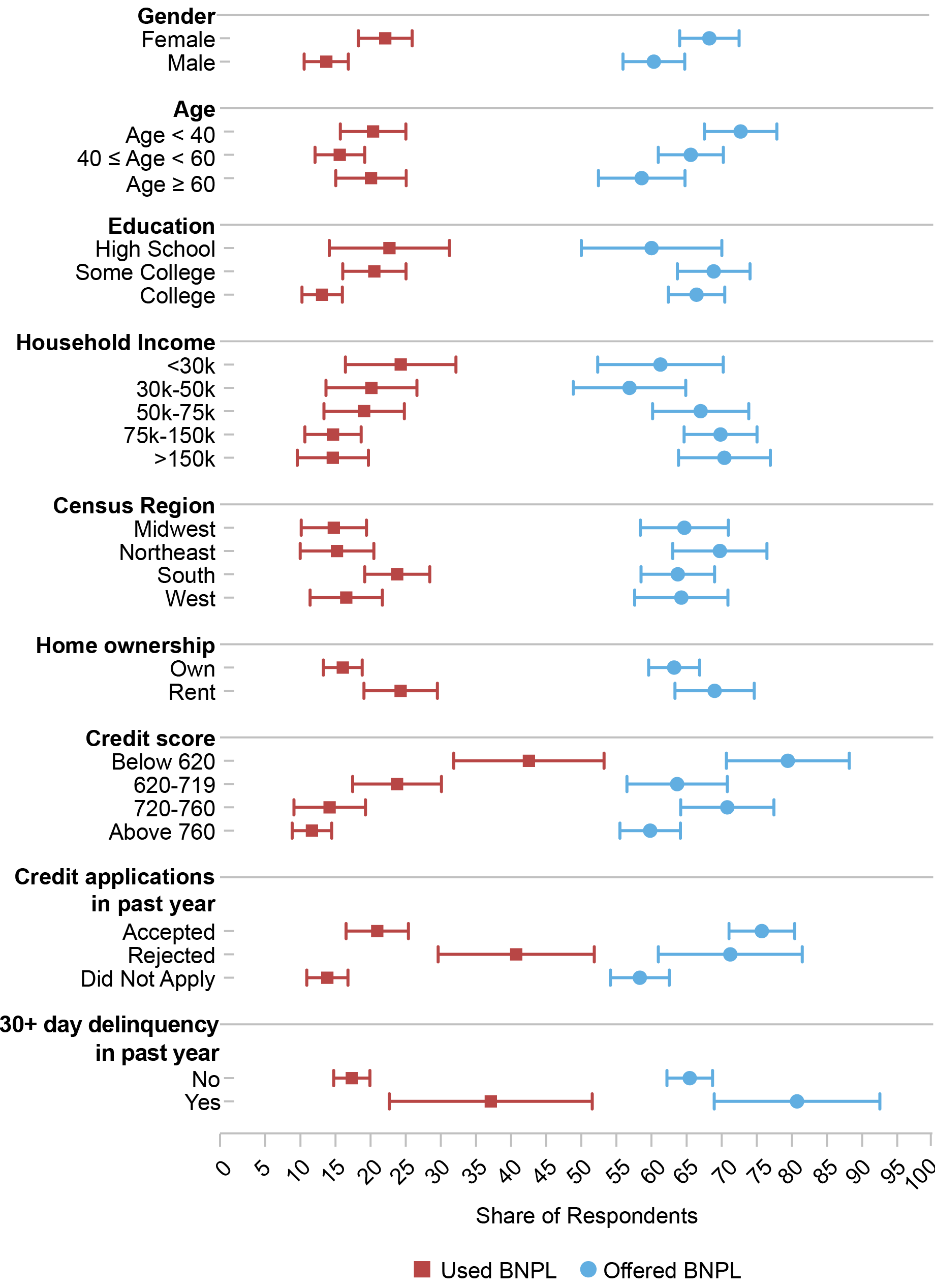

While not all respondents are equally likely to have encountered the BNPL option, the experience is remarkably broad-based, with a majority in all demographic and socioeconomic groups reporting having been offered the payment option. The chart below shows how the “offered” share (blue dots, with confidence intervals) varies with respondent characteristics. Female and younger respondents and those with higher household income are more likely to report encountering the BNPL option. 60 percent of respondents with credit scores above 760 have received a BNPL offer, compared to about 80 percent of those with credit scores below 620. Interestingly, those who had a credit application rejected or were delinquent on a loan over the past year were also more likely to have been offered the BNPL option. These differences are likely to reflect both the availability, and possible targeting, of this payment option, combined with what is being purchased and from where. In addition, they may to some extent reflect interest in and awareness (and memory) of a BNPL option, which could be demand-driven.

Survey Results: Engagement with BNPL

Source: Survey responses from the New York Fed’s Survey of Consumer Expectations (SCE) Credit Access Survey.

Notes: The question corresponding to “offered BNPL” was: “Some stores offer payment plans with a ‘buy now, pay later’ option, whereby customers do not pay for the full price at the time of purchase, but rather pay later in several installments. (These payment plans are often offered through companies such as Affirm, Afterpay, and Klarna.) Have you ever been offered such a “buy now, pay later” option?” The question corresponding to “used BNPL past year” was: “In the past year, have you purchased anything using a ‘buy now, pay later’ option?”

Who Uses BNPL?

There is greater variability across groups when considering the rate at which BNPL was actually used over the past year. As shown in the chart above, we find BNPL use (shown in red with confidence intervals) to be somewhat higher for females, renters, individuals without a college degree, and to be monotonically decreasing in income (these patterns are largely consistent with the 2023 CFPB report). While lower income individuals are less likely to be offered BNPL they are more likely to use it. Overall 19 percent of individuals used BNPL, but BNPL usage is noticeably higher for those with credit scores below 620 (43 percent) and those who were thirty days or more delinquent at some point during the past year (37 percent). Those who applied for some other type of credit over the past year (an indicator of higher credit demand), generally were also more likely to report using BNPL in the past year, compared to those who did not apply for credit. Among those who applied for credit, BNPL use was particularly high for those who reported a credit application rejection over the past year (41 percent). Of course, these various respondent traits are correlated with each other, suggesting the need for a multivariate analysis: when controlling for all covariates jointly in a multivariate regression, the higher rates for those with low credit scores or a recent credit application rejection remain highly statistically significant.

Despite being fairly broad-based, with significant take-up among higher educated and higher income respondents, overall we find that those with lower credit scores and greater unmet credit needs make up a disproportionate share of all BNPL users. Indeed, 32.7 percent of BNPL users either held a credit score of less than 620, reported having a credit application rejected, or were delinquent on a loan over the past year; this group, meanwhile, represents just 16.6 percent of our full sample. Furthermore, we find BNPL users to be overall more financially fragile, as measured by the average likelihood of being able to come up with $2,000 in the next month in case of an emergency. That probability stands at 66 percent across all respondents and respondents that have ever been offered the BNPL option, but only 52 percent among those who reported using BNPL over the past year. BNPL users are also less likely to rely on savings when facing a financial shock. While 68 percent of all respondents would rely on savings to come up with the needed funds, only 42 percent of BNPL users would. Instead, they report that they are more likely to rely on borrowing (from friends, family, banks, or credit cards). The fact that a disproportionate share of BNPL users are already financially fragile raises questions about the resilience of BNPL lending and its performance following an adverse economic shock.

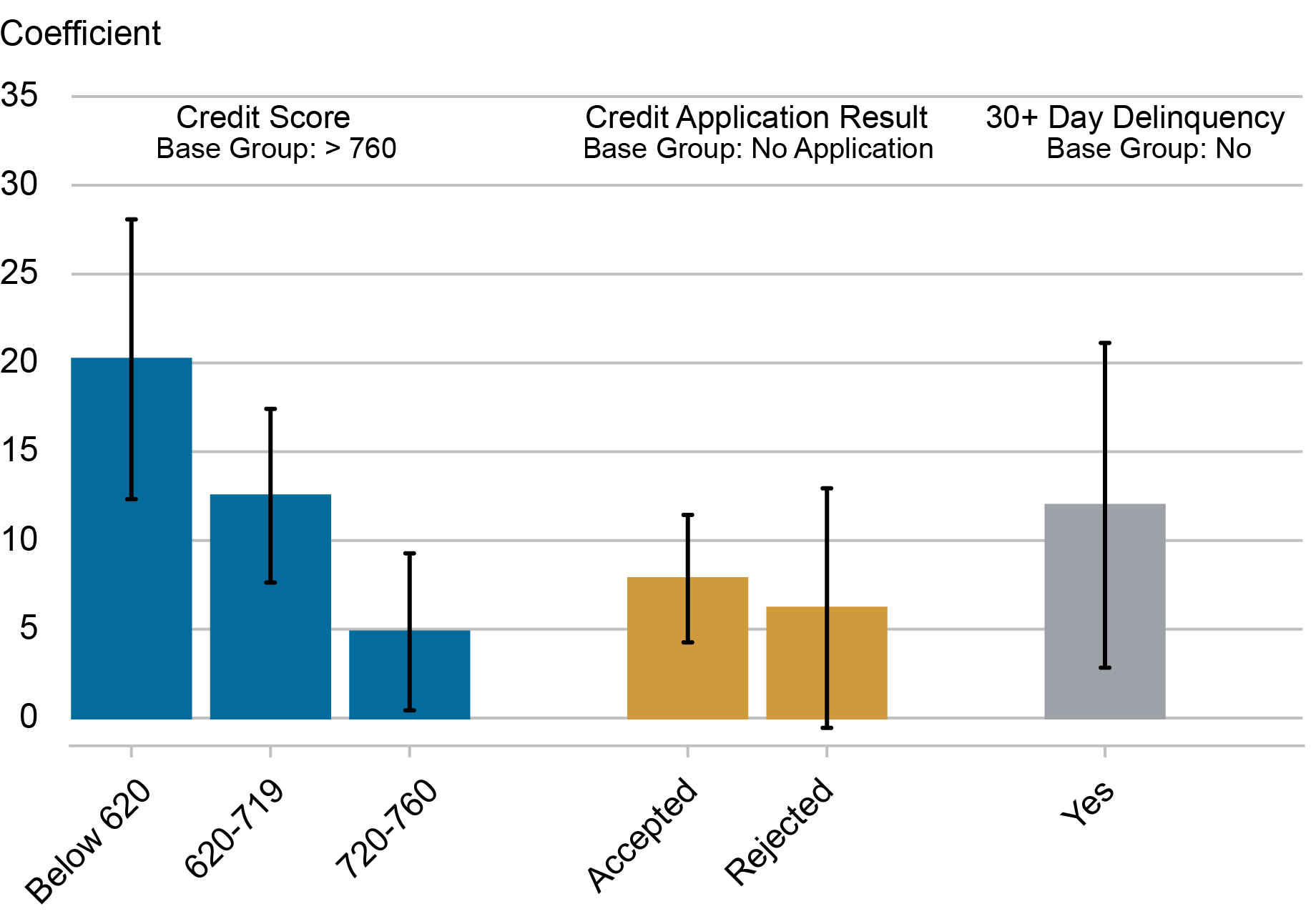

BNPL Increases Financial Inclusion, but Not Without Risk

BNPL usage may reflect demand as well as supply factors. For example, those with lower incomes and credit scores may find interest-free BNPL financing more attractive and affordable, or may have greater access to such loans due to where (at what retailers) BNPL is offered. It could also capture a lower credit score and loan delinquency that were the result of, rather than reason for, BNPL use (debt over-extension), although most BNPL loans are not reported to credit bureaus. To further examine the extent to which these patterns reflect demand, rather than “targeting,” we related a respondent’s background and circumstances to their expected year-ahead BNPL use. We again find a much higher reported average probability of using BNPL over the next year among those with lower credit scores and those who had a credit application rejected over the past year. Controlling for all covariates jointly in a regression does not alter these findings, as shown by the estimated marginal effects in the chart below. These results therefore suggest that while BNPL may not benefit unbanked consumers or those who are “credit invisible” or unscorable, BNPL loans appear particularly attractive to those with unmet credit needs and limited credit access. Representing an additional attractive source of credit to help borrowers smooth consumption and manage their debt payments at lower cost, BNPL may thus expand financial inclusion, especially to those with low credit scores.

Marginal Effects on Average Probability of Using BNPL in the Next Year

Note: The reference groups for the estimated effects are those with credit scores above 760, who did not apply for credit in the past year and was not late on a debt payment over the past year.

At the same time, our evidence substantiates to some extent a concern expressed by some BNPL critics, that BNPL may attract consumers who already have financial difficulties and are struggling to pay their existing bills and debt payments. We cannot dismiss the potential risks of overextension, whereby frequent use of BNPL funding leads to excessive debt accumulation over time, affecting a consumer’s ability to meet non-BNPL obligations. The fact that many BNPL lenders do not currently furnish data to the major credit reporting agencies could contribute to such risks, as both BNPL lenders and other institutions will be unaware of a borrower’s current liabilities when deciding to originate new loans.

Also concerning in this regard is that BNPL might be enabling consumers to spend (and borrow) more than they otherwise would, rather than simply shifting purchases to a new payment platform. Berg et al (2023) find causal evidence for this, showing that customers spend 20 percent more when BNPL is available, with less creditworthy customers being most responsive to BNPL offers.

So while our findings indicate that BNPL services enjoy broad-based interest, appear to fill a gap in the credit market, and expand credit access and financial inclusion, more data and analysis are needed to investigate the extent to which BNPL borrowing may contribute to greater financial stress and affect overall financial well-being, especially over the course of the business cycle.

Felix Aidala is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Daniel Mangrum is a research economist in Equitable Growth Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is the economic research advisor for Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Felix Aidala, Daniel Mangrum, and Wilbert van der Klaauw, “Who Uses “Buy Now, Pay Later?”,” Federal Reserve Bank of New York Liberty Street Economics, September 26, 2023, https://libertystreeteconomics.newyorkfed.org/2023/09/who-uses-buy-now-pay-later/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).